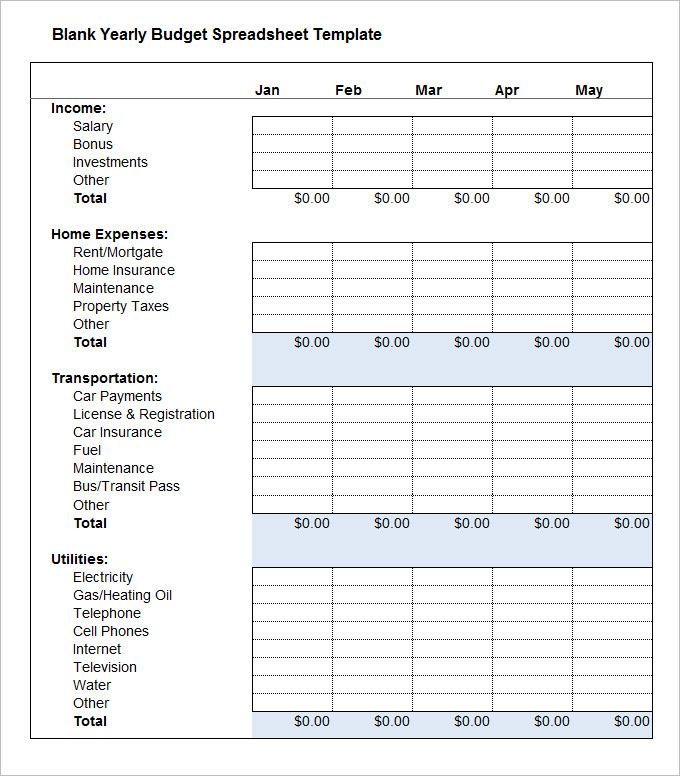

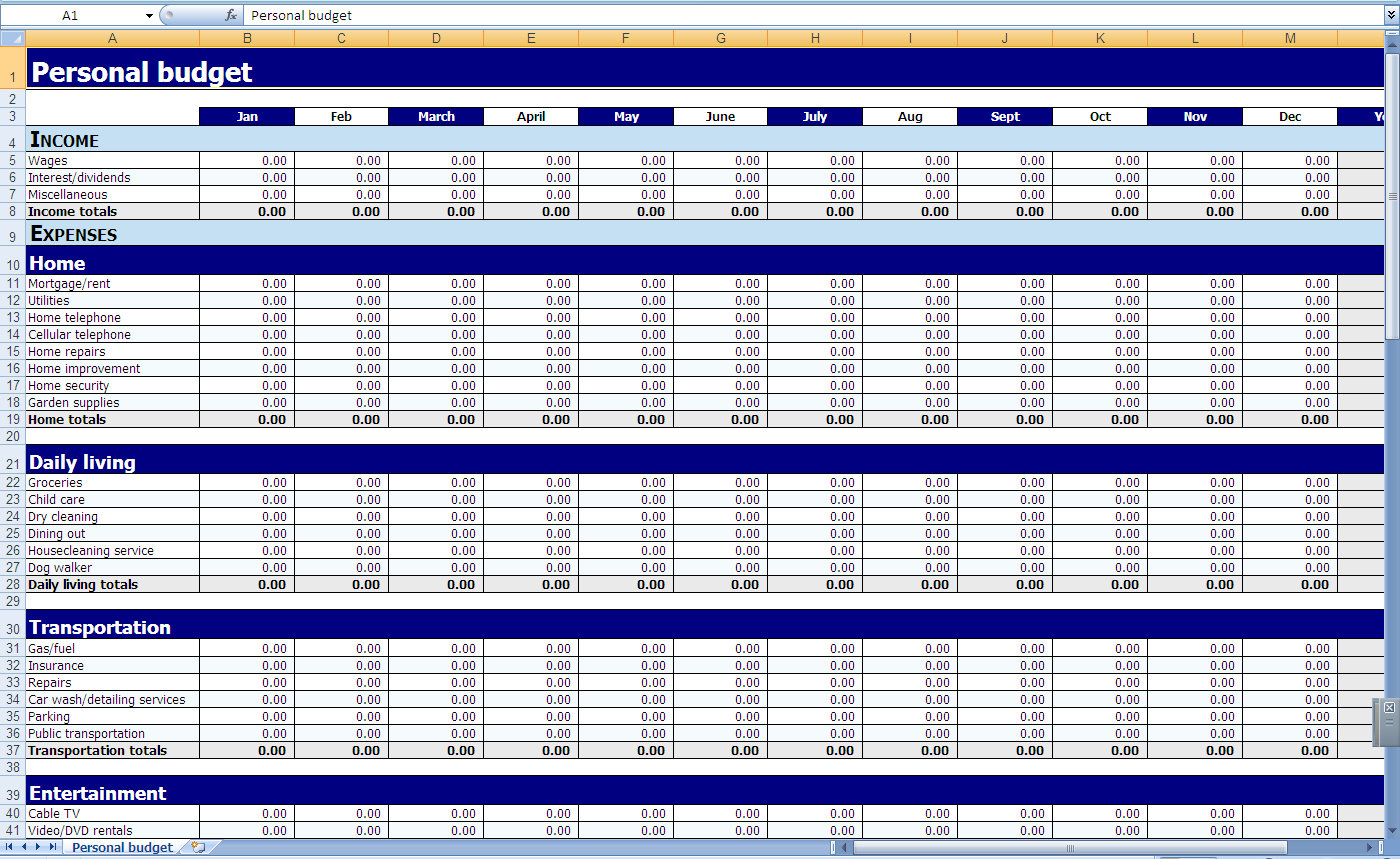

Gives control over spending and saving: Setting a budget allows you to categorize your spending and to save into clear categories, which allows you to control where your money is going and dictate your spending on a deeper level. However, sticking to a budget is much trickier and requires you to stick to several rules:Ĭontinue to regularly track your expensesĮxecute weekly budget check-ins, so you remain on track with your budget goalsĬonstantly review your budget to factor in changes to expenses or income Essentially this category of your monthly budget can include anything other than utilities and other necessary payments.Ĭreating a budget is the first step and one that many people are capable of completing. To do this, you can create expense categories and create a specific budget category for unnecessary expenses, such as a Netflix account or a gym membership. If you are unhappy with your end number, revisit your expenses and see if any can be removed. The higher the number, the more profit you make each month. Once you have established those two figures, subtract your expenses from your income, and see what number you end up with. It will also include other expenses such as food, gym memberships, TV memberships, and other variable and negotiable costs. That list will include non-negotiable expenses, like rent, utilities, and other essential outgoings. Secondly, establish a list of all of your monthly expenses. This number should factor in taxes, and any payments that fluctuate each month should be averaged out.

Make a list containing all of these sources of income and tally up what the overall total is each month. That might include your salary, freelance payments, inheritance from family, benefits, and other monthly incomings. Your monthly budget planner will highlight your actual spending habits and cash flow if done correctly.įirstly, you need to establish every source of income you have. Take away your expenses from your budget. Whether you require an intuitive budget template or a basic budgeting template, we've got you covered!Ĭreating a Google Sheets budget spreadsheet is simple once you understand the process. Simple Sheets offers a wide range of free budget templates to choose from on Google Sheets or Microsoft Excel.

The suitable free monthly budget template will provide oversight into your total earnings and costs and allow you to budget accordingly for plans, purchases, or holidays. A personal monthly budget template is an excellent document for anyone who wants to grasp their finances and establish how much they are earning and spending each month.

0 kommentar(er)

0 kommentar(er)